As we discussed in a previous post, CA AB5 is having a drastic impact on the gig economy in California. So the question on most employers’ minds is, what can staffing firms and HR departments do to meet the demands of AB5?

The Gig Economy

The gig economy significantly changed the hiring process, with employers hiring independent contractors and freelancers instead of traditional, full-time employees. Based on flexibility and temporary jobs, workers often rely on online platforms to connect with their customers and secure a ‘gig’.

According to the Freelancers Union, 57 million people freelanced in America in 2019 – 4 million more than the previous year. This represents 35% of the entire workforce and contributed nearly 1 trillion dollars to the economy. It spans a range of activities, from delivering food to babysitting. It’s not yet clear what the impact of the pandemic may have on those numbers, but it’s safe to say various businesses across multiple industries now leverage a greater number of independent contractors.

CA AB5

As we mentioned before, CA AB5 (or the gig worker bill) requires companies that hire independent contractors to reclassify them as employees. Most workers are presumed to be employees, should be classified accordingly, and the burden of proof for classifying workers as independent contractors falls to the hiring entity and should be in accordance with the ABC Test.

As ballots such as Proposition 22 are passed, the list of exemptions to Assembly Bill 5 is growing longer. The bill has multiple layers and can be challenging to understand. With the gig economy affecting millions of workers throughout America, ensuring that your workers are classified properly and keeping up with regulations is more important than ever.

Why is it so challenging? Many companies have both employees and independent contractors. Some retail businesses, for instance, have full-time or part-time employees for their daily operations, such as cashiers or store managers.

However, they may also offer services such as installations, which require specialized skills but not full-time workers. Some of these businesses may also increase their staff to meet demand (such as holiday demand). All of these factors can make worker classification more challenging under CA AB5.

Classifying Workers

The Internal Revenue Service provides a detailed breakdown of what constitutes an employee versus an independent contractor for federal tax purposes. Employers must withhold income tax and pay Social Security, Medicare taxes and unemployment tax for any employee, but not for independent contractors. Contractors must pay self-employment tax on their earnings.

Generally, a worker is an independent contractor if the hiring entity can control the result of the work performed, but not how it is done or what is done. There are three categories for classifying a worker – Behavioral Control, Financial Control and the Relationship of the Parties.

- Behavioral Control: A worker is an employee when the company has the right to direct and control the work performed by the worker.

- Financial Control: Does the business have a right to direct or control the financial and business aspects of the worker’s job? Among other factors, an employee is guaranteed a regular wage for a certain period of time, while independent contractors mostly work for a flat fee.

- Relationship: The type of relationship depends upon how the worker and business perceive their interaction with one another. This includes benefits, the length of the relationship between the employer and worker, and the extent to which services performed by the worker are seen as key to the company.

Meeting the Demands of CA5

This is where technology and staffing firms offer value to corporate employers, perhaps now more than ever. There are numerous benefits to using a third party for hiring purposes, starting with how many smaller organizations may not have an internal HR department and lack the necessary resources to find the perfect workers.

Larger companies may have the resources, but third-party options can save them time and money by connecting them to broader networks of job candidates than the company could reach on its own. Traditional job boards, social media or company websites don’t always attract the right candidates, particularly if the desired workers are specialized in a certain skill.

These platforms and agencies provide other benefits, too. The best of them are well-versed in regulatory compliance, so with regulations constantly changing and new ones emerging, such as CA AB5, that’s more important than ever – and a lack of compliance can have severe consequences. If a court finds a company is guilty of willfully violating AB5, penalties might run from $5,000 to $25,000 per violation.

There are multiple steps you can take to ensure you comply with CA AB5 and other related regulations.

- Run a compliance check

First of all, whether it’s a corporate HR department or a staffing firm, it should audit its own practices and processes to be sure it’s in compliance with AB5. What kind of positions are we hiring against? How many of those fall under the definitions set out by AB5? This needs to be a stem-to-stern appraisal of where, how, and why independent contractors are being engaged.

- Stay informed

As Proposition 22 illustrates, CA AB5 can be amended after being enacted. It’s crucial to stay up-to-date on any and all changes to the bill, and considering the initial furor over the bill and the many parties involved, it’s highly likely there’ll be pressure for new amendments and exemptions in the legislative terms to come.

- Consult a lawyer

Whether you have a lawyer or use an online legal technology company for your business, consulting specialists can help you understand if your workers need to be reclassified. They can help the HR department understand the potential changes necessary to stay compliant, and even how to structure relationships with independent contractors in the future.

- Talk to Payroll

Payroll specialists can help explain how CA AB5 can affect you and your business. Reclassification will affect how much you spend on payroll, so asking for an estimate can help you prepare better (remember to factor in the additional benefits). Unless you fall under the exemptions, you may have several workers that need to be reclassified.

- Consider a new contractor recruitment model

With AB5 in force, it might be beneficial to consider a new contractor recruitment methodology. A company may have recruited contractors on its own, but maybe it’s time to consider outsourcing to a staffing agency; retaining workers through a staffing agency means they’ll take on the burden of responsibility for treating workers as their employees, and they already have the infrastructure to deal with transient workers.

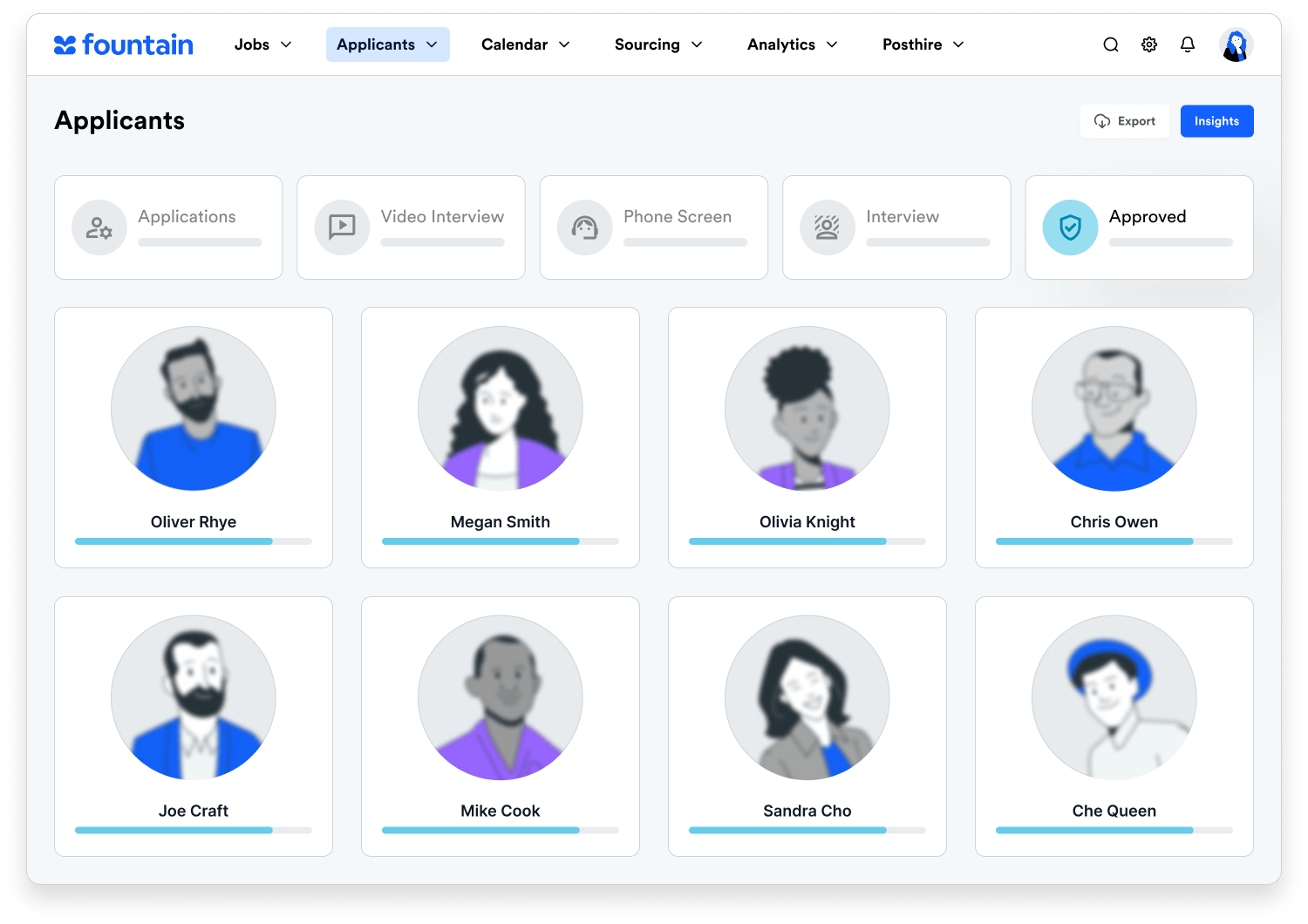

For HR departments or staffing firms, it could be the right time to commit to a digital recruitment and onboarding platform that can help you automate compliance with existing regulation and new (and evolving) laws like CA AB5.